USER ACQUISITION

The UA Mobile Gaming Survival Guide for 2026: The Trends and Best Plays

Maria de la Puente

10 mins read

21 Nov 2025

UA in 2026 isn’t polite,

but here's how to make it work

Forget cheap installs and easy lookalikes—that era’s dead.

In 2026, UA is a knife fight in the dark, and scaling isn't easy; there are no device IDs, creatives that burn out faster than your morning espresso, and an audience that’s more expensive and distracted than ever.

The cheap-install gold rush of the 2010s and early 2020s collapsed under the weight of privacy regulation, market saturation, and platform dependency. Apple’s ATT and Google’s Privacy Sandbox effectively ended the era of precision targeting, while AI unleashed a flood of content that made creative differentiation harder than ever.

Meanwhile, consumers have evolved too: they’re savvier, ad-blind, and juggling more distractions across more devices than at any point in history. Every installation is a small victory in an ecosystem that has grown more expensive, more competitive, and far less predictable.

The chaos was inevitable but there's still a massive opportunity.

Mobile gaming has matured into a $120+ billion industry, attracting massive investment, consolidation, and creative arms races. As new markets like LATAM, India, and MENA come online, the next wave of growth won’t come from buying cheaper installs—it’ll come from more brilliant, faster iteration, creative excellence, and retention-first thinking. UA in 2026 isn’t about finding loopholes in attribution; it’s about surviving in a system designed to reward adaptability over scale.

Teams that know how to move fast, test smarter, and align UA with retention are still scaling, while everyone else is bleeding out.

That’s why we built this: a survival guide for UA in 2026.

What does UA look like in 2026 for Mobile Apps and Games?

Where is the mobile gaming market at?

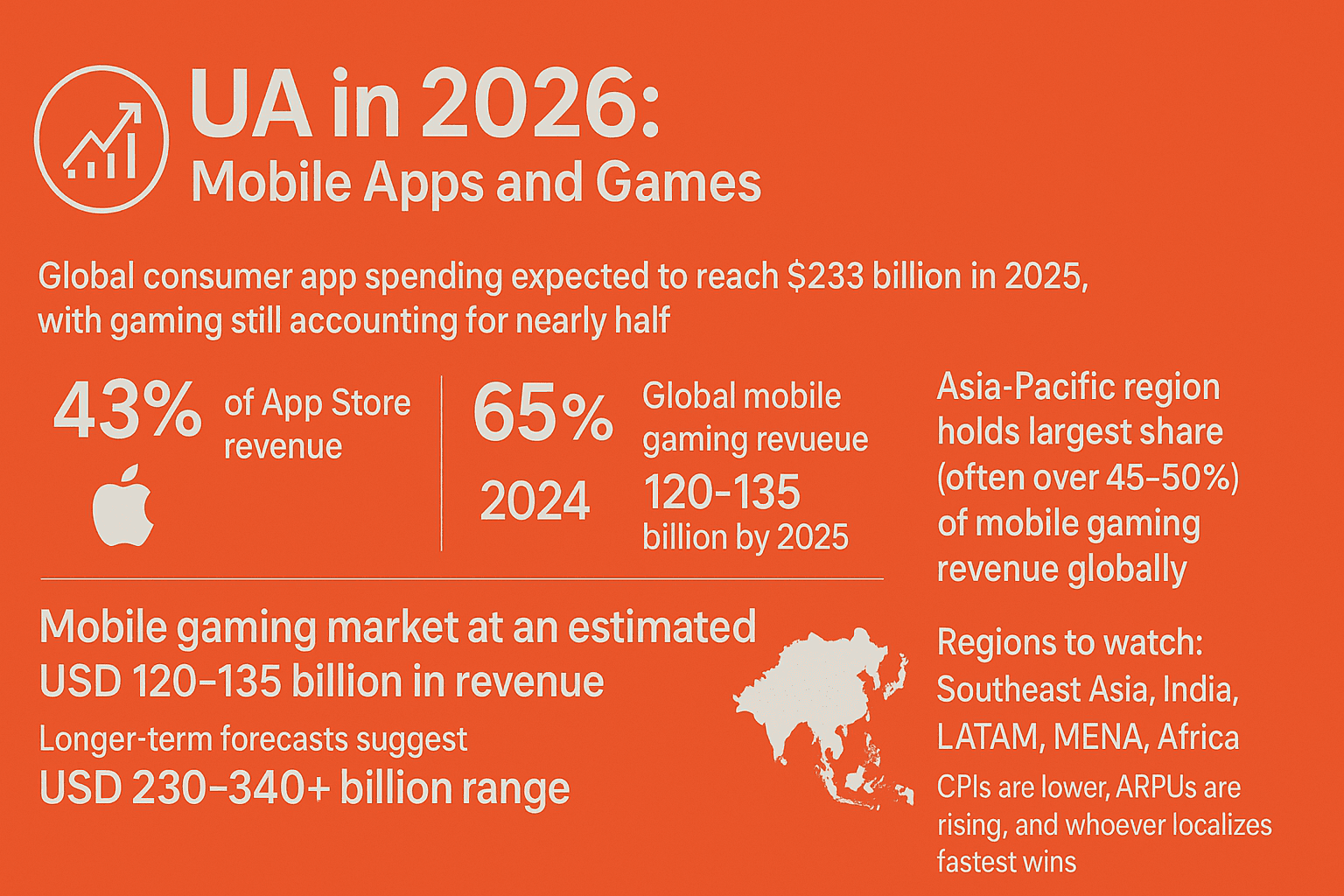

Global consumer app spending was expected to reach $233 billion in 2025, with gaming still accounting for nearly half of it. (SensorTower App Market Forecast) with 43% of App Store revenue and 65% of Google Play by 2026.

The mobile gaming market is expected to reach an estimated USD 120-135 billion in revenue. And longer‐term forecasts (to ~2030-2034) suggest the market could roughly double or more, i.e., be in the USD 230-340+ billion range.

The iOS gaming segment alone is worth $ 80 billion (2024), while global mobile gaming revenue was expected to reach $120–135 billion in 2025.

The Asia-Pacific region currently holds the largest share (often over 45-50%) of mobile gaming revenue globally.

The number of mobile gamers worldwide is in the order of 2.8-3.3 billion people.

Regions to watch: Southeast Asia, India, LATAM, MENA, Africa. CPIs are lower, ARPUs are rising, and whoever localizes fastest wins.

We asked some of the most switched-on people in the industry to share the one play they’d bet on this year. Think of it as your field kit — proven tactics you can deploy right now to stay alive, grow, and win.

What are the BIGGEST Challenges in User Acquisition in 2026?

Mobile is still a monster for gaming and there's money to be made. Global app spend continues to climb, with mobile games accounting for nearly half of all gaming revenue, and emerging markets remaining wide open. AI has finally made creative production scalable, and teams that embrace it can test 50 concepts before lunch.

For those who move fast, the opportunity is bigger than ever.

Buuut that doesn't mean that there aren't challenges. We could write a whole article on these, but you're probably already aware of most of them. We've just highlighted the most significant challenges we're facing ahead of the year to come.

Attribution is a proper mess!

Postbacks are delayed, noisy, and often incomplete. CPIs in the US and Europe are climbing out of reach, creative fatigue is real, and “easy wins” on Facebook/Google are not as easy as they once were.

Then there's ad fatigue.

You can’t just throw money at an ad set and expect magic anymore. As with all marketing efforts, it's about reaching the right people at the right time with the right message.

High Costs and competition

Many studios are spending millions without knowing how much of it is actually driving new users versus cannibalizing organic installs.

Privacy issues

Apple’s SKAdNetwork and Google’s Privacy Sandbox mean you’ll never see installs the way you used to. Aggregated postbacks and predictive modeling are the new normal. If you’re still mourning IDFA, you’re stuck in 2020. Meanwhile, privacy rules keep tightening, regulators are circling around monetization practices, and one platform policy shift can wipe out your entire playbook overnight.

AI forging creative competition

This could very well be a challenge this year as the market is flooded now with tons of cheap creatives, essentially increasing the creative levels to heights never seen before aka the creative competition just exploded

It can spit out 100 ad variants before your Slack standup ends.

But volume isn’t necessarily value. The most innovative teams pair AI speed with ruthless human editing and testing.

Retention > installs

Anyone can buy traffic. Few can keep it. UA budgets now live or die by D7 and D30 retention, as well as true incremental LTV.

9 Trends Redefining UA in 2026

1. The Amazing Creative Race

In a crowded market where users are exposed to thousands of ads daily (digital marketers estimate between 4,000 and 10,000 ads per day), creative assets are the primary lever for competitive advantage.

Ad fatigue is brutal: your “winning” creative might burn out in two weeks. To combat ad fatigue—where diminishing returns are seen from repeated ad exposure—brands must continuously refresh content and leverage A/B testing.

Motivation-Based Creatives: Ad creatives should utilize player motivations (such as self-expression, relaxation, or progression) to reach specific, high-quality users. For instance, to target players driven by self-expression, video ads should emphasize customization features.

Utilizing Trends: Successful ad concepts often follow trends, such as "fail ads" (which make the game seem more challenging) or story-based ads (popular for casual games targeting women). Observing competitors through tools like Facebook’s Ad Library helps identify these trends for adaptation and informed decision-making.

Playable Ads: These interactive advertisements offer a short demo before download, effectively capturing interest. Users who engage with playable ads have conversion rates that are 3 to 5 times higher than those who simply watch static ads or trailers.

Video Dominance: Video ads have proven to be the best choice for advertising mobile games, as they allow developers to showcase the full game experience, including a catchy intro, riveting gameplay, and a clear Call-to-Action (CTA)

Best play: Generate fast, test faster, and kill losers without mercy BUT human-polished ad creative is non-negotiable—nobody wants an uncanny valley wizard hawking gems in your RPG ad.

2. Mastering the Measurement Challenge

Sustainable UA is defined by maximizing ROI by balancing Cost Per Install (CPI) with Lifetime Value (LTV). Measuring these metrics accurately is a core challenge, particularly amid increasing concerns about data privacy.

Key Metrics to Monitor: Successful UA requires continuously monitoring Key Performance Indicators (KPIs), including CPI, Cost per Acquisition (CPA), retention rates (Day 1, Day 7, Day 30), as well as LTV.

The LTV Imperative: LTV is the total revenue a player generates throughout their time playing the game. Measuring advertising spend against LTV is crucial to determining if campaigns are profitable.

Attribution in a Privacy-First World: Changes in privacy (like Apple’s IDFA changes) and increased regulations make it harder to personalize campaigns. Advertisers must expect innovation in attribution modeling, with solutions like probabilistic modeling helping address the challenges of gathering actionable campaign data.

“You can't just focus on Cost per Acquisition (CPA) anymore. Increasing emphasis on Lifetime Value (LTV) and the quality of acquired customers is key” - Jennifer Matthews, Former VP of Brand Strategy at FanDuel.

Best play: Measure CPI, Cost per Acquisition (CPA), retention rates (Day 1, Day 7, Day 30), as well as LTV to get the best overall picture.

3. The Rise of AI and Automation

As if we didn't all know that this one was coming!

Artificial Intelligence (AI) is already causing disruption, making it easier to launch and iterate apps. By 2026, AI is expected to play a more dominant role in optimizing campaigns.

AI-Powered Optimization: Machine learning tools will enable real-time adjustments to ad campaigns for better performance. Platforms like Facebook already offer Automated App Ads (AAA) options, simplifying campaign creation and dynamically testing creative combinations.

AI in Creative: We expect to see enhanced AI-powered testing tools provided by companies like Meta, Google, and Apple, allowing for A/B testing of audio, copy, and design elements.

Best play: Use AI for automation where possible and definitely for testing.

4. Influencers and Community Building

Given the creative battle at play, it's no surprise that studios are turning to influencers and community. Tapping into creator economies and fostering loyalty through community remain top-tier UA strategies.

Influencer Credibility: Influencer marketing allows developers to showcase gameplay authentically, helping to reach niche gaming communities. Over half of marketers, 51%, think that influencer marketing helps attract high-quality customers.

Community Platforms: Building communities on platforms like Discord and Reddit is can be a boost. Direct engagement in these spaces fosters loyalty, generates word-of-mouth referrals, and encourages organic growth. Given Reddit's massive reach, with 70 million daily active users, this isn't surprising.

Best play: Influencers don't have to mean big budgets; find niche influencers and you can get massive game bang for your buck. Better yet, tie your game to a movie, sports league, or influencer. It’s not just marketing—it’s instant credibility.

5. Monetization + UA: The Power Couple

Hybrid monetization (ads + IAP + subs) changes the game. While subscriptions are standard, especially in specific app categories, the future involves hybrid monetization models and strategic pricing.

35% of apps now mix subscriptions with consumables or lifetime purchases. Gaming (61.7%) and Social & Lifestyle (39.4%) lead the way, showing that hybrid models can boost revenue without sacrificing subscriber value. (RevenueCat)

Gaming apps are leading the trend of combining subscriptions with consumables (in-app purchases). This hybrid approach allows apps to monetize different user segments more effectively, reducing churn and improving retention. UA has to see through to actual monetization outcomes. Chasing whales only works if your retention design can keep them swimming.

Pricing for LTV: Apps with higher price points generate significantly higher LTV. High-priced apps generated nearly seven times the median LTV ($55.21) compared to low-priced apps (RevenueCat) over one year, showing that premium pricing captures more long-term value per payer.

•Subscription Duration: While yearly plans offer the highest retention rates (often exceeding 50–60% at 12 months) and stronger LTV, Gaming apps overwhelmingly favour shorter trials, with 96.3% lasting four days or less.

Best play: Make UA and product teams sit at the same table. Growth is a full-stack job now, and everyone needs to be revenue-focused and accountable.

6. Privacy-First Measurement

The reality of modern UA is that reliable attribution is increasingly difficult due to privacy regulations and platform limitations (like SKAdNetwork and Google’s Privacy Sandbox). Developers must stop chasing perfect data—it doesn’t exist anymore.

Building for Uncertainty: Data privacy concerns limit the ability to personalize campaigns and impact acquisition efficiency. Advertisers must expect innovation in attribution modeling. Solutions may include probabilistic modeling, along with deep linking and Device ID matching, to help address the challenges of gathering actionable campaign data.

Signal Recovery: Advanced Self-Attributing Networks (SRNs) on platforms like TikTok, Meta, and Snapchat are working to restore key data points after iOS signal loss.

Best play: Run incrementality tests on every major channel. If you’re scaling without holdouts, you’re flying blind. This practice ensures you are measuring the true lift in conversions attributable to your ad spend, rather than relying solely on noisy conversion values.

7. Journey-Driven UA to Activation

The install is just the opening act. Successful UA requires maximizing conversion post-download by ensuring the in-app experience matches the ad promise.

Speed to Value: The vast majority of users start a trial immediately upon download, with conversion rates exceeding 80% on Day 0. This hammers home how crucial your onboarding experience is—you have "one shot to get it right".

Dynamic Onboarding: Optimizing onboarding flows to maximize trial start rates is a huge source of leverage. This includes streamlining registration and personalizing the new user experience (e.g., using a brief onboarding quiz).

Activation Over Install: Developers must focus on getting users to activate (e.g., completing key tasks in the trial) rather than just signing up. Users who complete at least two workouts in a trial are far more likely to convert and remain subscribers long-term.

Best Play: If your ad offers a 50-coin starter pack, land users directly in a flow that gives it to them. Fulfilling the ad promise requires strong deep linking capabilities. Break the promise, and they’ll churn before level 2.

8. New Channels Rising

Meta and Google aren’t enough. CTV, retail media, influencer networks, and OEM/telco bundles are delivering scale.

Cross-Promotion: Cross-promo inside your own portfolio? It’s the cheapest UA you’ll ever buy. Cross-promotion helps build a community and enhances user acquisition efforts by tapping into a pre-existing audience. Now is the perfect time to focus on growing your portfolio through cross-promotion with the booming mobile gaming industry.

Alternative Platforms: Reddit is investing in app install campaigns, making it an overlooked but promising UA channel.

Testing for Advantage: It is important to constantly test out new channels because performance can change overnight.

Best play: Carve out 10% of spend for “test” channels. The payoff isn’t always immediate, but first-mover advantage matters, and diversifying your advertising mix means you’re not reliant on a single channel.

Okay, we said 9, but we really want to emphasise this, not as a trend but as a real focus for 2026

Retention-First UA

Nearly 30% of annual subscriptions cancel within the first month. (RevenuCat)

Buying installs is easy but keeping players is war.

Optimizing campaigns for retention—D7 > 30%, D30 > 10%—is now the baseline. Sustainable UA is defined by maximizing ROI by balancing cost per install (CPI) with player Lifetime Value (LTV).

• Focus on Quality: The main goal is not just to acquire as many users as possible, but to acquire high-quality users who will regularly play your game, and spend on in-app purchases or engage with ads. High churn rates undermine acquisition efforts.

• Optimizing for the Long Term: Metrics must be monitored continuously, including user retention, session number and length, and LTV. These metrics will tell you a lot about the quality of the users acquired.

• Retention Targets: While retention varies significantly by category (Gaming apps show notably lower retention across plan types compared to others), optimizing campaigns for healthy retention rates is the baseline.

Best play: Stop celebrating CPIs. Tie every UA dollar to projected LTV and retention. If a channel can’t deliver long-term users, cut it, as sustained engagement is crucial for long-term growth.

A Summary of the Best UA Plays for 2026

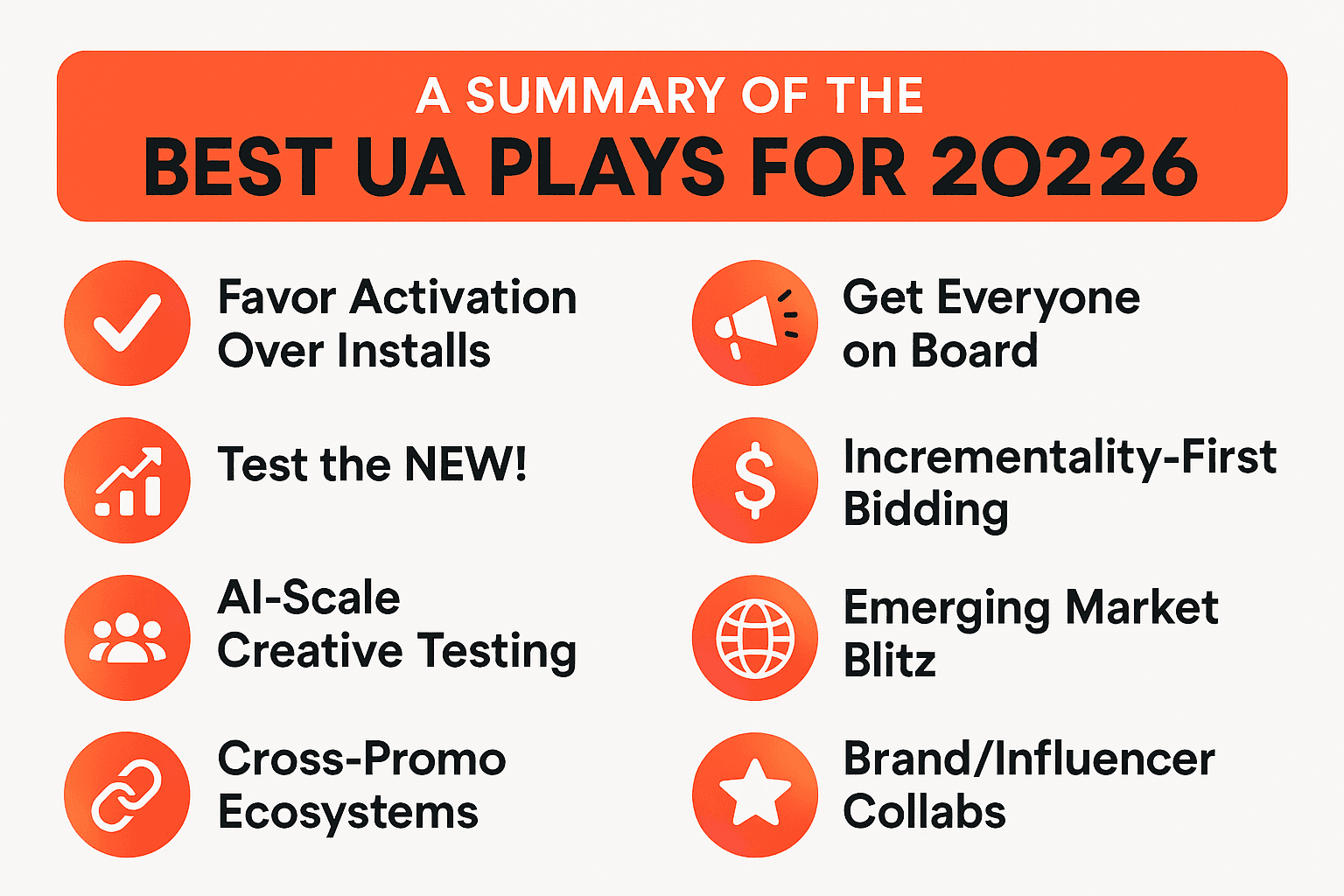

Favor activation over installs and retention over activation.

Test the NEW! New creative but also new channels. Carve out 10% of spend for “test” channels.

Measure across the board: Measure CPI, Cost per Acquisition (CPA), retention rates (Day 1, Day 7, Day 30), as well as LTV to get the best overall picture.

AI-Scale Creative Testing: Pump out dozens of ad variants weekly. Test hard, cut harder.

Get everyone on board: Make UA and product teams sit at the same table. Growth is a full-stack job now, and everyone needs to be revenue-focused and accountable.

Incrementality-First Bidding: No more “trust the algorithm.” Run geo holdouts and prove uplift before scaling.

Emerging Market Blitz: Translate, localize, partner with telcos and influencers. LATAM and MENA are today’s gold rush.

Cross-Promo Ecosystems: Turn your existing apps into UA machines for your new ones.

Brand/Influencer Collabs: Tie your game to a movie, sports league, or influencer. It’s not just marketing—it’s instant credibility.

Watch Out for these Risks in Your UA Strategy for 2026

Creative fatigue happens faster than you can hire designers. Solve it with AI pipelines and ruthless pruning.

Over-automation. If you let the machines run everything, you’ll optimize yourself into irrelevance.

Regulatory shocks. Monetization tactics are under fire (loot boxes, predatory mechanics). Stay compliant or risk PR and platform bans.

CPI inflation in mature markets. Don’t throw good money after bad installs.

Final Word

What options are available for studios in 2026 for UA strategies? It's easy to get lost in so many tactics, but don't forget the basics.

Social media

Referal strategies

App Store Optimization (ASO)

And NB: Use analytics and data to drive decision-making.

UA in 2026 is brutal, fast, and expensive—but it’s also full of upside. The teams that win won't be the ones with the most significant budgets.

They’re the ones who:

Move at creative speed with AI.

Prove value with incrementality, not vanity metrics.

Bet early on emerging markets and new channels.

Align UA and monetization like they’re the same game (because they are).

Play like that, and you won’t just survive 2026—you’ll own it.

Produced by Hubapps.team for reference and strategic inspiration. For more insights into building scalable creatives for your mobile games and apps and smarter UA pipelines, visit hubapps.team