UA

Mobile gaming in 2025 wasn’t just bigger — it was more competitive, more fragmented, and more dominated by category-defining winners than ever. The top games weren’t just hits; they were growth engines, retention machines, and live-ops powerhouses built on years of iteration and disciplined execution.

But the real question for studios going into isn’t “Which games are the most played?”

It’s:

“What can we learn from the games dominating 2025?”

Because behind every chart-topping title lies a set of patterns — in design, UA, monetization, and live ops — that any studio can apply.

We looked at the top mobile games of 2025, not just because they topped the charts, but as a growth playbook for studios aiming to launch the next hit.

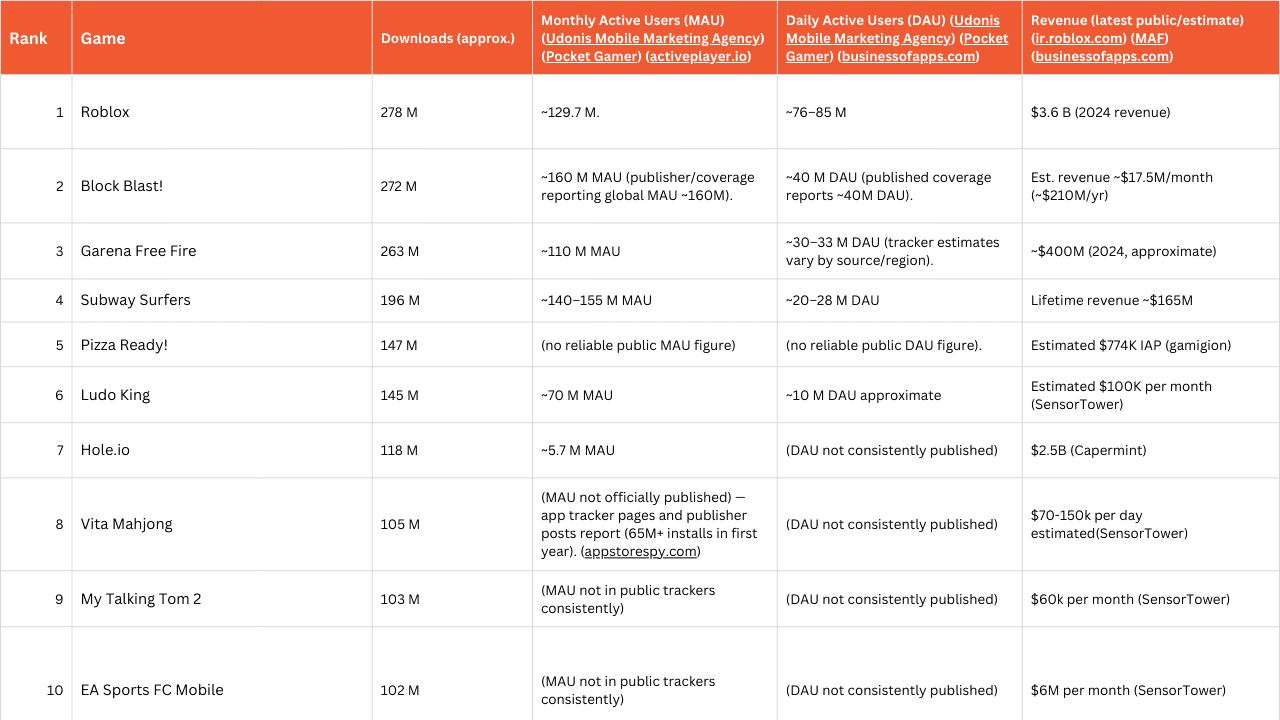

Lessons from the TOP 10 Mobile Games of 2025

1. Cross-Platform Ecosystems Continue to Dominate

Examples: Roblox, Genshin Impact, Honkai: Star Rail

These aren’t just games — they’re universes. Games like Roblox show that community platforms are now central to the experience. And the proof is in the pudding

Roblox alone sees more than 70M daily players¹, with the majority coming from mobile.

Why they win

Massive UGC (user-generated content) ecosystems

Seamless cross-platform progression

Never-ending content

Built-in social loops

High session depth (25–30+ minutes per session)

What your studio can learn

Long-term retention requires long-term content

Even small studios can adopt lightweight creator tools or weekly micro-events.Cross-platform = long-term LTV

More devices = more touchpoints = more retention.Social loops are not optional

Even minimal guilds, friend lists, or competitions dramatically increase return rates.

2. Puzzle Giants Still Win on Volume + Frequency

Examples: Candy Crush Saga, Royal Match, Fishdom, Township, Match 3 Games

Puzzle games continue to dominate MAUs thanks to habit loops and high-frequency play.

Royal Match now exceeds 45M MAU with nearly 5 sessions/day² — a hyper-sticky engagement profile rivaling social apps.

Why they win

Minigames

ASMR visuals

Extremely low cognitive load with positive psychological feedback

Infinite level pipelines

Predictable daily rituals

UA-friendly creative formats with sky-high CTR

What your studio can learn

Session design matters more than complexity

Build for 2–5 minute loops.Level production is the real content pipeline

Treat levels like live ops — not static content.Creative matters more than gameplay

Puzzles win because they can “sell the fantasy” in 5 seconds.

If you’re building puzzle:

Test your hook, not your levels. Test your theme, not your boosters.

If the creative doesn’t perform, the game never will.

3. Merge Games Own the “Relaxed Progression” Category

Examples: Gossip Harbor, Travel Town, Merge Mansion-style titles

Merge is the most consistently growing casual subgenre in 2024–2025 according to Data.ai³.

Why they win

Infinite merge chains = infinite progression

Strong narrative hooks

UA creatives perform extremely well including fake ads

Frequent events and booster-driven monetization

What your studio can learn

Merge is about economy design, not just merging

The most successful merge games are sophisticated resource systems disguised as casual gameplay.Narrative boosts retention by 10–20% as per GameAnalytics benchmarks

Don’t overbuild — soft launch early to validate merge chain pacing

Merge failure is almost always pacing failure.

4. Battle Royale & Shooter Games Thrive Through Competitive Loops

Examples: Free Fire, PUBG Mobile, Call of Duty: Mobile, Fortnite

These titles continue to dominate engagement with long average session times (25–32 minutes) and strong multiplayer loops. (Out of interest, did you know that males tend to play for longer sessions that females. Makes sense if you think about it. Females usually play for stress relief - which is why ASMR is so important for female gamers. But we have a whole other post for that topic.

Back to the most played games of 2025!

Fortnite made its return to the Apple App Store in the United States in May 2025 (and saw 1.85 million downloads that month), after a nearly five-year absence following a U.S. court ruling that found Apple in violation of an antitrust order.

It's one of the most downloaded games of 2025 with registered Players that surpassed 650 million registered users by 2025.

Why they win

High skill expression

Seasonal resets

Team-based replayability

Large content pipelines

Esports infrastructure

What your studio can learn

Competition is a retention engine

Even lightweight competitive modes dramatically increase session depth.Seasonal systems reset the economy and give players a reason to return

Players tolerate complexity if the core fantasy is strong

Shooters win because the core loop is endlessly replayable.

5. 4X Strategy Is Still the LTV King

Examples: Whiteout Survival, Evony, Last War

These games are not always the most downloaded — but they are among the highest-grossing.

Whiteout Survival players average 8.6 sessions/day with 20+ min sessions⁵ — extraordinary engagement metrics.

Why they win

Many live ops!

Alliances and social strategy

Resource scarcity

Timers and synchronous warfare

Long-term meta depth

Event-based monetization

What your studio can learn

You’re building a service, not a game

4X is live ops + events + analytics more than “game design.”Whale-driven monetization requires extremely stable early retention

If D1 & D7 fail, LTV modeling collapses.Community governance is a feature

Strong alliance systems = strong LTV.

6. Social Casino + “Light Competition” Reaches New Heights

Examples: Coin Master, MONOPOLY GO!

These games have mastered “easy-to-understand, hard-to-stop” loops.

MONOPOLY GO! now dominates the casual charts with 16M+ MAU and nearly 7 sessions/day⁶.

Why they win

No skill barrier

Fast rewards

High social friction (steal/raid loops)

FOMO-driven daily events

What your studio can learn

You don’t need deep gameplay — you need deep events

These games win through live ops, not mechanics.Social pain (stealing/raiding) > social sharing

Negative friction loops outperform “share with friends” in this category.

7. Live-Ops Monsters Dominate Their Genres

Examples: Pokémon GO, Brawl Stars, Honor of Kings

These are games that survive — and thrive — through relentless live updates.

Why they win

Constant content refresh

Predictable monthly calendars

Rotating meta

Strong social ecosystems

Seasonal battles / regional events

What your studio can learn

A live ops calendar isn’t a feature — it’s your growth engine

Events are retention levers

Meta change = user reactivation

If you want long-term LTV, you need long-term systems.

What These Winners Reveal About Growth for 2026

Across all categories, three patterns define the leaders:

⭐ Pattern #1: Retention First, Everything Else Second

Top games invest months or years into refining FTUE, session design, and progression before pushing UA.

Why?

Because CPIs in 2025 were brutal — up 18% YoY⁴.

Retention is the only antidote.

⭐ Pattern #2: Content Pipelines Matter More Than Core Mechanics

The winners are:

content engines

event engines

community engines

This is how they sustain DAU for years (or a decade).

⭐ Pattern #3: UA Is a Science, NOT a Broadcast

The top games:

aggressively test creatives

constantly refresh their hooks

scale only when signal is strong

localize strategically

optimize per platform (TikTok ≠ Meta ≠ Unity)

Conclusion: The Future Favors Prepared Studios

The top mobile games of 2025 aren’t accidents. They are the output of:

disciplined early testing

strong retention fundamentals

predictable content pipelines

powerful social loops

sophisticated UA execution

If your studio can apply even a fraction of these systems, your next launch stands a far greater chance of joining this list — or competing with it.

Want to Build a Game That Can Compete in 2025?

First, check out our article on testing your game before launch.

Hubapps helps studios validate, launch, and scale mobile titles with embedded UA, creative, analytics, and retention expertise.

👉 Book a discovery call — and build a game built for success, not chance.

References

Business of Apps, Royal Match Performance Overview, 2024.

Data.ai — State of Mobile Gaming 2024 (Merge genre growth trends).

AppsFlyer — Performance Index & CPI Benchmarks 2024.

Related Articles